PH BIR 2305 1999 free printable template

Show details

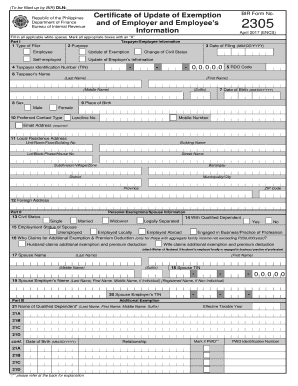

DAN: Republican NG Filipinas Catamaran NG Pananalapi Hawaiian NG Rental Internal Certificate of Update of Exemption and of Employer's and Employee's Information BIR Form No. 2305 July 1999 (ENDS)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your bir form 2305 november form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bir form 2305 november form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bir form 2305 november 2014 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2305 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

PH BIR 2305 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out bir form 2305 november

How to fill out bir form 2305 november:

01

Obtain a copy of the BIR Form 2305 November edition from the official website of the Bureau of Internal Revenue or from any BIR authorized printing service provider.

02

Fill out the personal information section of the form, which includes your taxpayer identification number (TIN), name, address, and date of birth.

03

Provide your civil status, if you are married, single, widow/widower, or separated.

04

Indicate your employment status, whether you are an employee or a self-employed individual.

05

If you are an employee, fill out the section for the employer's information, including the employer's TIN, company name, and address.

06

If you have multiple employers, complete the details for each additional employer in the designated spaces provided on the form.

07

Declare the total number of qualified dependents that you have, if applicable.

08

Specify the applicable tax exemptions, deductions, and tax relief you are entitled to claim.

09

If you want to update or change your tax exemptions or deductions, indicate the changes in the appropriate boxes provided.

10

Review the completed form and ensure that all the information you have provided is accurate and up-to-date.

11

Sign the form, affixing your signature and date of signing.

Who needs bir form 2305 november:

01

Individuals who need to update their information with the Bureau of Internal Revenue.

02

Employees who have changes in their employment status, such as starting a new job or resigning from a previous one.

03

Individuals who have changes in their personal circumstances, such as getting married, having a child, or experiencing changes in their dependent status.

04

Self-employed individuals who need to update their tax exemptions, deductions, and other relevant information.

05

Those who want to apply for or modify their tax relief benefits.

Note: It is advisable to consult with a tax professional or visit the BIR office for any specific concerns or queries regarding the proper completion of the BIR Form 2305 November edition.

Video instructions and help with filling out and completing bir form 2305 november 2014

Instructions and Help about 2305 form

Fill 2305 bir : Try Risk Free

What is bir form 2305?

Form 2305 is used to update your tax status and employer information. This is used when you move companies, when you change your legal status (such as when you get married) or when you add dependents (such as when you have children).

People Also Ask about bir form 2305 november 2014

What is 2305?

What is the return period of 1601EQ?

How do I file BIR 1601EQ?

How do I update my tax status Philippines?

What is BIR Form No 1601-EQ?

What is BIR Form 1601eq?

Who needs to file 1601EQ?

What is the use of 1905?

How can I change my tax status Philippines?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is bir form 2305 november?

BIR Form 2305 is an annual Income Tax Return for Self-employed Individuals, Estates and Trusts with Annual Income of More Than P250,000. It is used to report the annual income and taxes paid for the calendar year. The form must be filed and submitted to the Bureau of Internal Revenue (BIR) by the 15th day of November every year.

What is the purpose of bir form 2305 november?

Bir Form 2305 November is a form used by employers to submit to the Bureau of Internal Revenue in the Philippines. It is used to report employee information, such as their names, addresses, and Tax Identification Numbers (TINs), as well as to withhold taxes from their salaries. This form is necessary so that the employer can accurately report their employees’ taxes to the government.

When is the deadline to file bir form 2305 november in 2023?

The deadline for filing the bir form 2305 in November 2023 is not yet known. The deadline for filing forms and documents is usually set by the Bureau of Internal Revenue (BIR) and is subject to change. It is recommended that taxpayers check with the BIR for the most up-to-date filing deadline information.

What is the penalty for the late filing of bir form 2305 november?

The penalty for the late filing of BIR Form 2305 is a fine of P1,000 per month or fraction thereof plus a surcharge of 25% of the amount of the tax due.

Who is required to file bir form 2305 november?

BIR Form 2305, also known as the Certificate of Update of Exemption and of Employer's and Employee's Information, must be filed by employees with the Bureau of Internal Revenue (BIR) in the Philippines. This form is used to update or make changes to an individual's personal and employment information, such as changes in marital status, change of address, change of dependents, and other relevant details. Generally, all employees in the Philippines are required to file BIR Form 2305 when there are changes to their personal and employment information.

How to fill out bir form 2305 november?

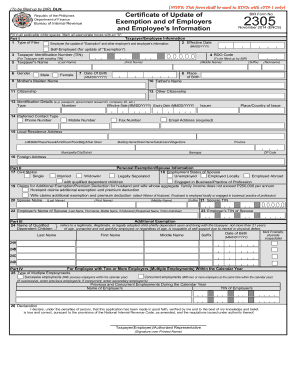

To fill out BIR Form 2305 for November, follow these steps:

1. Obtain a copy of the BIR Form 2305 from the Bureau of Internal Revenue (BIR) website or from your employer.

2. Provide your personal information in the topmost part of the form, including your TIN (Tax Identification Number), RDO (Revenue District Office) Code, and registered name.

3. In Part I - Employee/Business Taxpayer's Information, fill in your current employer's details, such as the name, address, TIN, and contact number.

4. Indicate your reason for filling out the form in Part II - Reason for Filing. Common reasons include "newly hired," "change in personal information," or "additional employer."

5. If you are updating your personal information, such as your civil status, change in registered name, change in dependents, or change in exemption status, provide the necessary details in Part III - Employee's Personal/Employment Information.

6. For any changes in your employer's information, such as change of registered trade name or address, provide the details in Part IV - Change of Employer’s Information.

7. Part V - Details of Previously Declared Additional Employer(s) should be filled out if you have other employers aside from the one mentioned in Part I.

8. If there are any details or information that cannot fit into the provided boxes, you can attach separate sheets of paper and label them accordingly.

9. Double-check all the information you provided to ensure accuracy and completeness.

10. Once completed, sign the form and submit it to the BIR or your employer, depending on their instructions.

Remember that this guide provides a general overview of how to fill out the form. It is essential to refer to the official instructions provided by the BIR or consult with a tax professional for specific guidance based on your circumstances.

What information must be reported on bir form 2305 november?

BIR Form 2305, also known as the Certificate of Update of Exemption and of Employer's and Employee's Information, is used to update the employee information of taxpayers. The form must include the following information:

1. Employer Information: Name, TIN, Address, and RDO Code of the employer.

2. Employee Information: Name, TIN, Address, and RDO Code of the employee.

3. Employment Status: Indicate the employment status of the employee (e.g., regular, temporary, casual, etc.).

4. Exemption Status: Specify the applicable exemption status of the employee, such as the basic personal exemption and additional exemptions for dependents.

5. Amendments in Exemption Status: If there are changes in the employee's exemption status, such as the addition or removal of dependents, these changes must be reported in this section.

6. Employer Information Update: If there are changes in the employer's information, such as name, address, or RDO Code, these changes should be indicated on the form.

7. Employee Information Update: If there are changes in the employee's information, such as name, address, or TIN, these changes should be indicated on the form.

It is important to note that the specific requirements and instructions for filling out BIR Form 2305 may vary based on the regulations and guidelines set by the local tax authority. It is advisable to consult the official instructions or seek assistance from a tax professional to ensure accurate completion of the form.

How can I manage my bir form 2305 november 2014 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign 2305 form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send bir form 2305 april 2017 excel format for eSignature?

When you're ready to share your bir form 2305 april 2017 excel, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for signing my bir form 2305 in Gmail?

Create your eSignature using pdfFiller and then eSign your bir 2305 form 2019 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Fill out your bir form 2305 november online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bir Form 2305 April 2017 Excel Format is not the form you're looking for?Search for another form here.

Keywords relevant to bir 2305 form

Related to bir 2305

If you believe that this page should be taken down, please follow our DMCA take down process

here

.